As per IDC’s latest Worldwide Quarterly Enterprise Storage Systems Tracker Q4 2020 release, India’s external storage market witnessed a decline of 15.6% year-over-year (YoY) by vendor revenue and stood at USD 77.1 million in Q4 2020 (Oct-Dec). The majority of the YoY decline in storage spending was due to decreased spending from banking organizations, while manufacturing, central government and security, and investment services saw a growth in Q4 2020. The full year decline for the external storage market in India during 2020 (Jan-Dec) was 21.8%.

“Digital Transformation is no longer a choice, forcing organizations to revisit their architectures to accommodate data proliferation from edge to core to cloud. It is essential for enterprises to drive business value, but this is not possible without the right platforms, so organizations are considering new-age intelligent infrastructure platforms,” says Dileep Nadimpalli, Research Manager, Enterprise Infrastructure, IDC India.

The growth of All-Flash Arrays (AFA) is evident across verticals with a contribution of 39.6% to the overall external storage systems market in Q4 2020. BFSI, professional services, manufacturing, and government verticals were the major contributors to AFA demand in Q4 2020. Stronger uptake of NVMe-based flash arrays is witnessed due to significant performance benefits with negligible cost differences. In the coming years, enterprises would prefer NVMe-based flash arrays as de facto storage media for all the production workloads.

All the Storage Class segments saw a sharp YoY decline in Q4 2020. Entry storage and high-end storage segments witnessed a strong YoY decline compared to midrange systems in Q4 2020. The impact of Entry storage is due to decreased storage demand from SMB and enterprises for their non-core applications.

All the Storage Class segments saw a sharp YoY decline in Q4 2020. Entry storage and high-end storage segments witnessed a strong YoY decline compared to midrange systems in Q4 2020. The impact of Entry storage is due to decreased storage demand from SMB and enterprises for their non-core applications.

Enterprises are investing in the modernization of applications/Infrastructure, seamless movement of data across multiple clouds, AI Ops for managing infrastructure platforms, and security to be digitally resilient. Organizations are looking for trusted advisors and not standalone technology deployment partners to enable them to be future-ready.

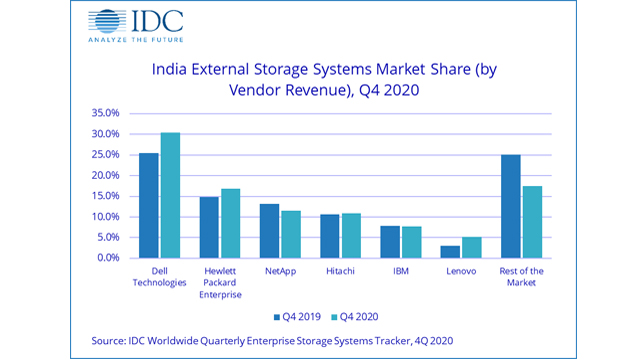

Dell Technologies continued to be the market leader in the external storage systems market with a 30.4% market share by vendor revenue, followed by Hewlett Packard Enterprise (HPE) with a 16.9% market share in 4Q 2020.